Altcoins: The Fragmented Landscape of Cryptocurrency Beyond Bitcoin’s Dominance

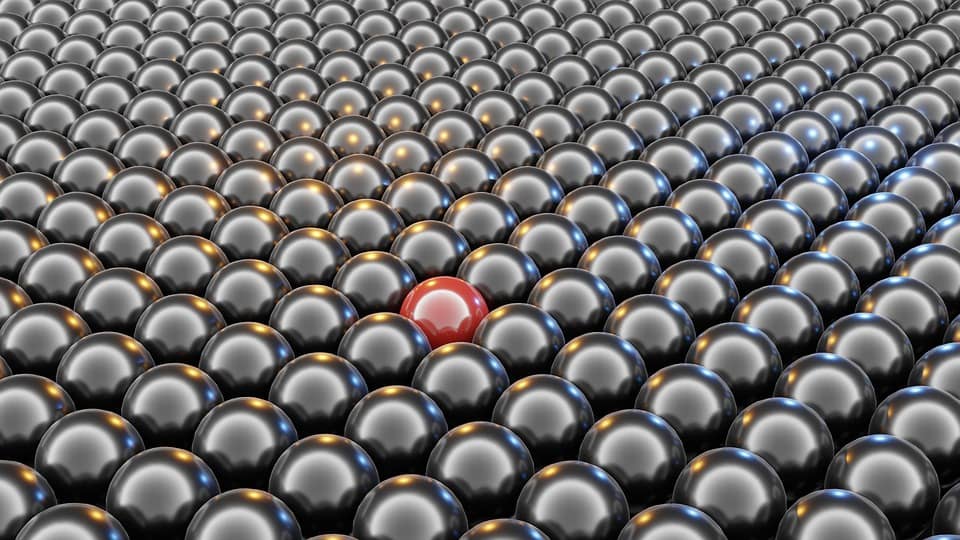

The world of cryptocurrency is no longer dominated by a single player. While Bitcoin (BTC) was once the supreme authority, the landscape has become increasingly diversified with the rise of altcoins. In this article, we’ll delve into the world of altcoins, exploring their characteristics, advantages, and challenges, as well as answering frequently asked questions about these alternative digital currencies.

What are Altcoins?

Altcoins, short for "alternative coins," refer to cryptocurrencies that are not Bitcoin (BTC). They are created on different blockchains, often using a modified version of the open-source code that underlies Bitcoin, known as the Bitcoin protocol. Altcoins can be created for various purposes, such as improved speed, increased privacy, or enhanced functionality.

Key Characteristics of Altcoins

- Blockchains: Altcoins operate on their own blockchain, which is a public ledger that records transactions and ensures the integrity of the network.

- Mining: Like Bitcoin, altcoins can be mined using computing power, although some alternative mining methods, like proof-of-stake (PoS) or proof-of-authority (PoA), have gained popularity.

- Supply and demand: The total supply of an altcoin can be fixed or uncapped, and its value can fluctuate based on supply and demand.

- Forks: When a significant change is made to the blockchain code, a fork occurs. This can result in two or more separate blockchains.

Types of Altcoins

- Minted altcoins: Created through a process similar to mining, these coins can be earned by solving complex mathematical problems or completing tasks.

- Pre-mined altcoins: A predetermined amount of coins is pre-distributed to their creators or early adopters.

- Hard fork altcoins: Resulting from changes made to a blockchain, these coins create a new blockchain with its own set of rules.

Advantages of Altcoins

- Improved speed and efficiency: Some altcoins, like Ethereum, have faster transaction processing speeds and lower fees compared to Bitcoin.

- Enhanced security: Certain altcoins, such as Monero, prioritize anonymity and privacy, making them appealing for users who value discretion.

- Innovation: Altcoins can introduce new features, like DeFi (Decentralized Finance) applications, gaming platforms, or social networks.

- Diversification: Investing in a diversified portfolio of altcoins can reduce reliance on a single asset, such as Bitcoin.

Challenges of Altcoins

- Liquidity: Altcoins often have lower liquidity and trading volumes compared to Bitcoin, making it more difficult to buy or sell them.

- Regulatory uncertainty: Many governments are still grappling with how to regulate the cryptocurrency space, leading to uncertainty and potential legal challenges for altcoin projects.

- Security: As newer and less established blockchains, altcoins can be more susceptible to hacking and security breaches.

- Market volatility: Altcoin prices can be highly volatile, with rapid price swings, which can be unsettling for investors.

Frequently Asked Questions (FAQs)

- What is the difference between a cryptocurrency and an altcoin? A cryptocurrency is a broad term that encompasses all digital currencies, while an altcoin is a specific type of cryptocurrency that is not Bitcoin.

- Can I invest in altcoins? Yes, many altcoins are available for trading on online exchanges, but be aware of the associated risks and perform thorough research before investing.

- Is my money safe in an altcoin? As with any investment, it’s essential to use reputable exchanges and adhere to basic security best practices, such as using strong passwords and two-factor authentication.

- Can I mine altcoins? Yes, many altcoins can be mined using personal computers or specialized mining equipment, but be aware of the significant energy consumption and potential health risks associated with mining.

- Are altcoins legal? The legal status of altcoins varies by jurisdiction. It’s crucial to familiarize yourself with local laws and regulations regarding cryptocurrency use.

Conclusion

The rise of altcoins has transformed the cryptocurrency landscape, offering a diverse range of options for investors, users, and developers. While altcoins present new opportunities for innovation and growth, it’s essential to be aware of the associated risks and challenges. By understanding the characteristics, advantages, and drawbacks of altcoins, you can make informed decisions about your involvement in the world of cryptocurrency. As the market continues to evolve, it’s likely that altcoins will play an increasingly important role in the development of the digital currency ecosystem.

Final Thoughts

In conclusion, the world of altcoins is characterized by diversity, complexity, and innovation. While Bitcoin remains the most widely recognized and widely traded cryptocurrency, altcoins offer a range of alternatives, each with its unique features, strengths, and weaknesses. As the landscape continues to shift, it’s crucial for investors, users, and developers to stay informed and adapt to the changing environment.

Remember, the key to success in the world of altcoins is knowledge, caution, and a willingness to adapt. By embracing the opportunities and challenges presented by these alternative digital currencies, you can navigate the ever-evolving landscape of the cryptocurrency world.

Leave a Reply